What will your income and expenses be in retirement?

Begin the process by listing your anticipated expenses as well as your sources of income in retirement, which might include pensions; retirement accounts such as 401(k) plans, IRAs and annuities; Social Security; savings; and a business. Then look at your anticipated expenses, dividing them into buckets — day-to-day expenses associated with your desired retirement lifestyle (food, housing, healthcare, hobbies) and other important or aspirational expenses (paying for college, traveling, purchasing a vacation home, giving to causes you care about). Leisure spending is generally considered aspirational.

Day-to-day expenses will require predictable sources of retirement income, because most are not optional and it’s unlikely you’ll be able to reduce them substantially. After you have a strategy for covering those, move on to the other category. You’ll probably have more flexibility in the costs for the important or aspirational items on your list and when you’ll need the money. Remember, too, that some costs, for things like commuting and clothing, might decline.

Once you’ve done that, your financial advisor can help you align your resources and investments with each of the buckets, Storey says. When investing for aspirational items, for instance, you may want to take on more risk than you might for the expenses you need to cover every day. And keep in mind that taxes are going to take a chunk out of your income. “We look at our retirement accounts and just say, for example, ‘I have $1 million,’” Storey says. “We don't say, ‘Actually, I have about $750,000, because 25% is going to go toward taxes.’” Pre-retirees often underestimate the taxes on distributions from tax-deferred accounts like traditional IRAs and 401(k)s, he notes. Your advisor can work with you and your tax professional to help you determine how much and when to withdraw from each account in order to minimize taxes while allowing the remaining funds to continue their potential for investment growth.

How much will you need for leisure spending?

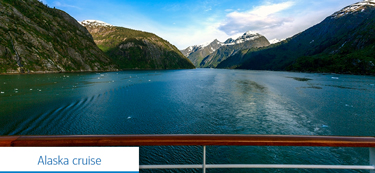

Next, create a rough estimate of what you think your leisure activities are likely to cost (for a look at the potential price tag of some common leisure activities, see the slideshow above). Your expenses are likely to change over the course of retirement, with leisure spending decreasing over time, Storey notes. According to the U.S. Bureau of Labor Statistics Consumer Expenditure Surveys, average out-of-pocket healthcare spending rises with age, while transportation, clothing and entertainment spending all decline.7